Many business owners casually say they plan to work forever. Sometimes it is said with pride. Sometimes it is said to avoid an uncomfortable conversation about succession, retirement, or letting go. Regardless of intent, treating “I’ll work forever” as a strategy rather than a sentiment introduces real and often overlooked risk into a business.

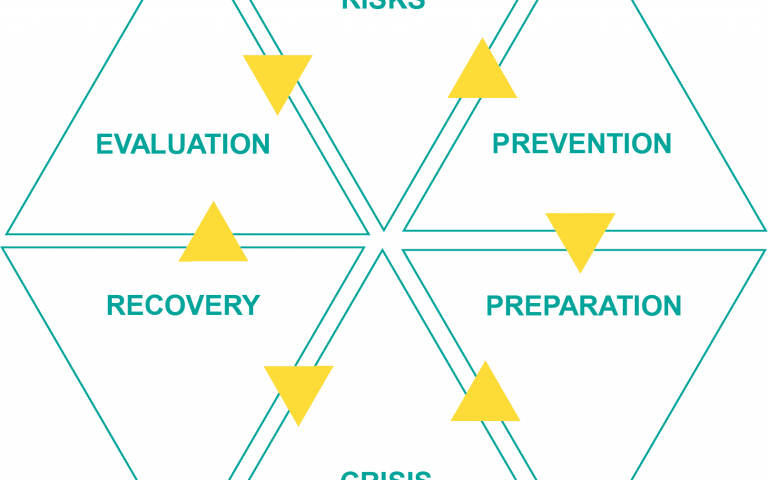

The first issue is that forever is not within anyone’s control. Health events, family needs, market disruptions, or simple burnout can force a change faster than expected. When a business is built around the assumption that the owner will always be present, any unplanned absence immediately becomes a business continuity problem. Customers, employees, lenders, and vendors all feel that uncertainty at the same time.

Owner dependence is one of the most common structural risks in privately held companies. When decisions, relationships, and institutional knowledge sit primarily with the owner, the business becomes difficult to operate without them. While this may feel manageable day to day, it quietly limits scalability, resilience, and long-term value. Businesses that cannot function independently struggle when unexpected transitions occur.

There is also a financial planning risk embedded in the idea of working forever. Many owners rely heavily on the business for income, identity, and net worth. Without a defined exit or transition plan, there is no clear understanding of how and when that value will be converted into liquidity. This can create a false sense of security, especially during strong operating years, and leave owners exposed if cash flow declines later in life.

From a valuation perspective, buyers and investors view the “forever owner” mindset as a red flag. A business that has never been prepared for ownership transition often lacks documented processes, bench strength, and reliable financial reporting. Even if the owner never intends to sell, these gaps affect borrowing capacity, partner discussions, and strategic options. The market discounts uncertainty, and owner dependence creates it.

Employees also pay attention to whether a long-term plan exists. When there is no visible path for leadership transition or ownership continuity, high-performing employees may limit their commitment or look elsewhere. Ambitious managers want to know whether there is opportunity ahead or whether they are permanently working under an owner who has no intention of stepping aside.

Another overlooked risk is decision fatigue. Owners who assume they will always be involved often delay investments in systems, delegation, and process improvement. Over time, this leads to the owner carrying an increasing operational burden. What begins as control eventually turns into exhaustion. Businesses that rely on constant owner intervention tend to plateau or decline as energy and focus fade.

There is also a tax planning cost to waiting. Many exit-related tax strategies require time to implement properly. Waiting until an owner is ready to slow down or is forced to step back can eliminate options that might have reduced risk or improved after-tax outcomes. Proactive planning provides flexibility. Reactive planning rarely does.

The “I’ll work forever” mindset can also distort risk tolerance. Owners may postpone addressing customer concentration, outdated systems, or succession gaps because they assume they will personally manage those risks indefinitely. Over time, those risks compound. When change finally becomes unavoidable, the window to address them has often closed.

Importantly, planning for a transition does not require a commitment to retire or sell. Exit planning is about creating options. A business that can operate without the owner provides freedom, whether that means stepping back gradually, pursuing new opportunities, or continuing to work by choice rather than necessity.

Businesses that are built to outlast their owners tend to perform better even while the owner remains active. Clear processes, strong leadership teams, and reliable financial information improve decision-making and reduce stress. These improvements benefit the owner today, not just some future buyer.

The idea of working forever is often rooted in passion and pride. There is nothing wrong with loving what you do. The risk arises when that belief replaces planning. Passion does not protect against disruption, and pride does not substitute for structure.

Ultimately, the most resilient businesses are not built around how long an owner wants to work. They are built to survive and thrive regardless of who is in the office. Owners who plan as if they might not always be there create stronger companies, better outcomes for employees and customers, and more personal flexibility.

Working forever may feel safe because it avoids hard decisions. In reality, it is the absence of a decision, and that is what creates risk.

***

TITAN Business Development Group, LLC

business coaching | advisory | exit planning