Aside from choosing the timing of your exit – or being prepared for such time, perhaps you have successors in mind. There is a litany of other non-financial aspects to consider. You may have identified a goal amount of cash you need now and/or in retirement (and if not, you will have after engaging with us). Yet the distressing reality is that most private business owners fail to gain full satisfaction when they do exit their business. In fact, statistically, around 75% of exited owners feel remorse within the first year after exiting their businesses. Couple that with the sobering fact that only roughly 70%-80% of private business even culminate in a successful transfer/sale!

There is one simple reason for this: they did not have a viable Exit Plan.

What is an Exit Plan?

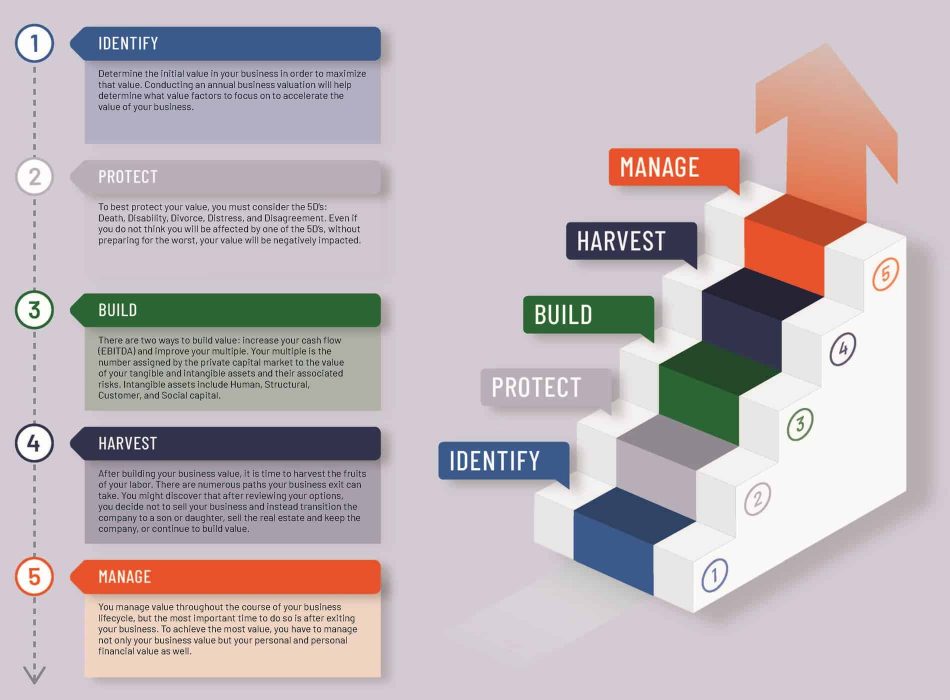

An Exit Plan is a comprehensive road map that helps business owners successfully exit a privately held business. An Exit Plan asks and answers all the critical questions that you must consider when exiting your company. It covers all the personal, financial, legal, tax and estate planning areas related to the exit. It also helps you consider various exit options, evaluate the pros and cons of each option, and select the right one for you.

Consider these EPI State of Owner Readiness Survey Results:

• Two-thirds of owners are not familiar with all of their exit options

• 78% have no formal transition team; 83% have no written transition plan; 49% have done no planning at all

• 93% have no formal life-after-business plan

• 40% have no plans in place to cover illness, death, or forced exit

• Half of all owners need the company to remain profitable during and after the transition plan, yet 86% have not taken on a strategic review or a value enhancement project

• 56% felt they had a good idea of what their business is worth, yet only 18% have had a formal valuation in the last two years

What are the Benefits of an Exit Plan?

A well-executed exit plan offers you the following advantages:

• Control of your own destiny – It helps you set goals: to whom you should transfer the business, when you should exit and how to realize the desired value of your business.

• Value maximization – It helps you focus on the key value drivers of the business and build its value to the desired level, while structuring the business to limit your taxes thus allowing you to keep the maximum amount of dollars.

• Higher likelihood of success – The sheer fact of setting goals and a developing a plan to reach these goals dramatically increases your chances to succeed. After all, there is a saying: “failing to plan is planning to fail.”

• Peace of mind for you – It creates peace of mind knowing that you have taken the necessary steps to ensure that your goals can be fulfilled.

• Peace of mind for your loved ones – They know that you have made the arrangements to avoid leaving them with a business they cannot handle if you are no longer able to manage it for reasons beyond your control.

When to make an Exit Plan?

All business owners should have an exit plan. When you get into a business, you should already know what you want to get out of the business. It is no coincidence that venture capitalists always ask entrepreneurs about their exit strategy before considering an investment.

If you don’t have an exit plan, it is probably time to start thinking about one. You should formalize an exit plan ideally 3 to 5 years before your actual exit. This generally leaves enough time to further build the value of your business, especially if is not yet at the desired value level.

Some Key Benefits of Exit Planning Using the Value Acceleration Methodology:

• Creates a roadmap to success

• Provides owner key deliverables and metrics

• Creates an increase in value by connecting daily activities to value

• Driver of organizational behavior

• Decreases potential risks to business

• Prioritization on owner and family wealth

• Inter-generational and employee development, transition, and measurement tool

• Helps deliver better strategies and structures that you can implement NOW for more sound operations today

Coupling the work you and our Certified Exit Planning Advisor (The CEPA designation is the most highly regarded exit planning credential in the marketplace today.) do along with benefits of our world-class coaching and advisory services, we can assure you that you will not only have an exemplary, individualized Plan, but one that is carefully implemented and monitored as well.